In this section we walk you through main energy storage technologies, services of Energy Storage Systems in the entire supply chain of energy as well as revenue streams of Energy Storage Systems.

Nobody

questions the need to switch to renewable energy sources. However, the growing

share of weather-dependent sources of electricity brings management of the grid

to uncharted territory. Unstable renewable energy sources make balancing of

generation and load in the National Power System a very challenging task.

Maintaining quality parameters of the electricity within specified ranged when

significant share comes from unstable renewable energy sources is increasingly difficult.

In power systems with low participation of weather-dependent sources, regulation

services, in particular primary and secondary regulation, are provided with the

use of the spinning reserve. As generation form renewable sources have priority

over conventional sources, there is no spinning reserve available at an

appropriate level to ensure stable parameters of electricity voltage and

frequency. The consequences may be destructive both for the energy

infrastructure and end users. The combination of these conditions forces the

implementation of high capacity energy storage systems both for balancing and

stabilization purposes.

Proven methods of energy storage, like Pumped-storage hydro power

plants (PSH), can be built only in limited number of locations in Poland (there

are five existing PSH and three more are planned). In addition, the PSH

construction process takes many years and may have unexpected implications for

the local environment. PSH responds to central needs and lacks flexibility. ESP

can be very helpful for balancing of transmission system however is not

suitable for local balancing and quality further down the distribution grid. It

is necessary to deploy alternative technologies. Taking into account the rapid

expansion of weather-dependent sources the deployment of battery energy storage

systems should be considered since it can be done in much less time and with

less interference with the local environment. The lack of enough capacity of energy

storage may stop any advances to increase share of clean renewable energy due

to grid stability and lack of other means to protect the power system from damage.

Even though energy storage batteries are less durable than other elements of

the power infrastructure it allows immediate and safe advances in implementation

of weather-dependent sources to the National Power System. It is very important

to deploy the relevant energy storage system and proper energy management

system to emulate synchronous generators and grid balancing.

Power

Grid Stability

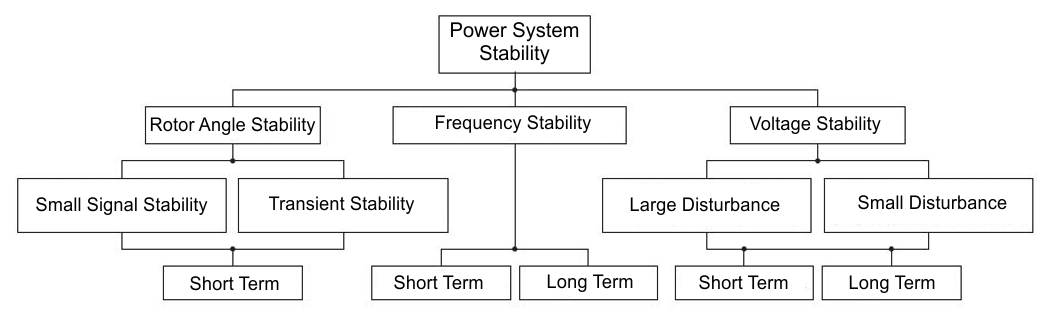

For angular stability the time domain of interest is short (0.1 to 10 seconds),

for frequency and voltage stability the duration of an excursion may be short

(fraction of seconds) or long (minutes). Though, stability is classified into

rotor angle, voltage and frequency stability they need not be independent

isolated events. A voltage collapse at a bus can lead to large excursions in

rotor angle and frequency. Similarly, large frequency deviations can lead to

large changes in voltage magnitude. The loss of stability may occur despite the

existence and operation of control automation and protections. [1] The angular stability is understood as

maintaining the synchronism of all synchronous generators operating in the

power system. As a result of the loss of angular stability of the power system,

serious system failures may occur, which will result in the lack of power

supply to a huge number of consumers. Along with the growing share of

generation from weather-dependent sources, the available spinning reserve

decreases, which translates into difficulties in ensuring the stability of the

power system. The weather-dependent sources themselves do not have a power

reserve to stabilize the network. Sufficiently large temporary disturbances in

the power balance may lead to loss of angular stability of the power system.

The solution to the problem is the emulation of a synchronous generator through

appropriate control of a large-scale battery energy storage. Such a device then

acts as a Virtual Synchronous Generator (VSG - virtual synchronous generator).

Calculation of the optimal VSG power in the National Power System is the

subject of research and analysis. According to some scientific works, a system

in which the installed capacity of wind farms and PV reaches 50% of the total

installed capacity requires a 4% share of the installed capacity of the energy

storage in order to ensure an adequate level of virtual inertia and frequency

control. [2] In

the case of systems with a small share of weather-dependent sources, the

minimum required size of the energy storage, the function of which would be the

emergency stabilization of the network, paradoxically may be higher.

Determining the optimal power and capacity of the energy storage for the energy

group's balancing purposes is to a greater extent a matter of the business

model, as there are usually several alternative balancing options, the common

denominator of which is the monetary cost of balancing.

[1] „Stabilność systemu elektroenergetycznego” J.

Machowski, Z. Lubośny

[2] “Sizing of an

Energy Storage System for Grid Inertial Response and Primary Frequency Reserve”

Knap, Vaclav; Chaudhary, Sanjay Kumar; Stroe, Daniel Loan; Swierczynski, Maciej

Jozef; Craciun, Bogdan-Ionut; Teodorescu, Remus

Quality

parameters of electricity in the distribution network

Further integration of weather-dependent electricity sources in Poland faces

significant obstacles as distribution network operators deny granting

connection conditions. DSOs claim they have no spare capacity in the grid. LV

and even MV sections of the gird fell victim to an array of incentives aimed

at small photovoltaic installations which

were granted do promote distributed energy sources. These incentives led to

accumulation of small non managed installations in agglomerations, whose daily

demand for electricity profile significantly differs from the profile of

electricity production from photovoltaic installations. Starting from the

statutory obligations of the distribution company, such as: the obligation to

ensure uninterrupted supplies of electricity that meet certain quality

parameters, the more weather-dependent RES, the more difficult it is to meet

these statutory obligations. Meeting these obligations requires very large

investments in network assets. Assets that are largely many decades old and

predate the concept of RES installations. Due to their characteristics, battery

energy storage is a natural solution of these problems. From the DSO's standpoint,

the main areas for use of energy storage systems are primarily the possibility

of stabilizing the quality parameters of electricity, but also the possibility

of postponing network investments. There are, of course, several other

functions of energy storage in the electricity supply chain that are worth

mentioning.

Balancing

the quantity of energy generated from weather-dependent sources with load

One of the greatest challenges for any further integration of photovoltaic and

wind farms in the Polish National Power System is that there is no correlation between

the energy supply and demand in a given period of time. However, the security

of the power system requires that the energy fed into the grid have almost the

same quantity as the energy consumed, on an ongoing basis. It should be

remembered that the regulations are such that when energy from renewable

sources is available, this energy has priority in feeding into the grid over

energy from conventional sources such as burning coal or gas. For technical

reasons, however, conventional power plants cannot be completely stopped. In

periods when the amount of energy from renewable sources and the minimum

possible generation from fuel combustion exceeds the current demand, it is

necessary to reduce production from renewable sources. Such curtailment is

called redispatching and is regulated in Regulation (EU) 2019/943 of the

European Parliament and of the Council of 5 June 2019 on the internal market in

electricity ("Regulation 2019/943").

More information on how large-scale energy storage can support wind generation can be found here: REDISPATCHING >>

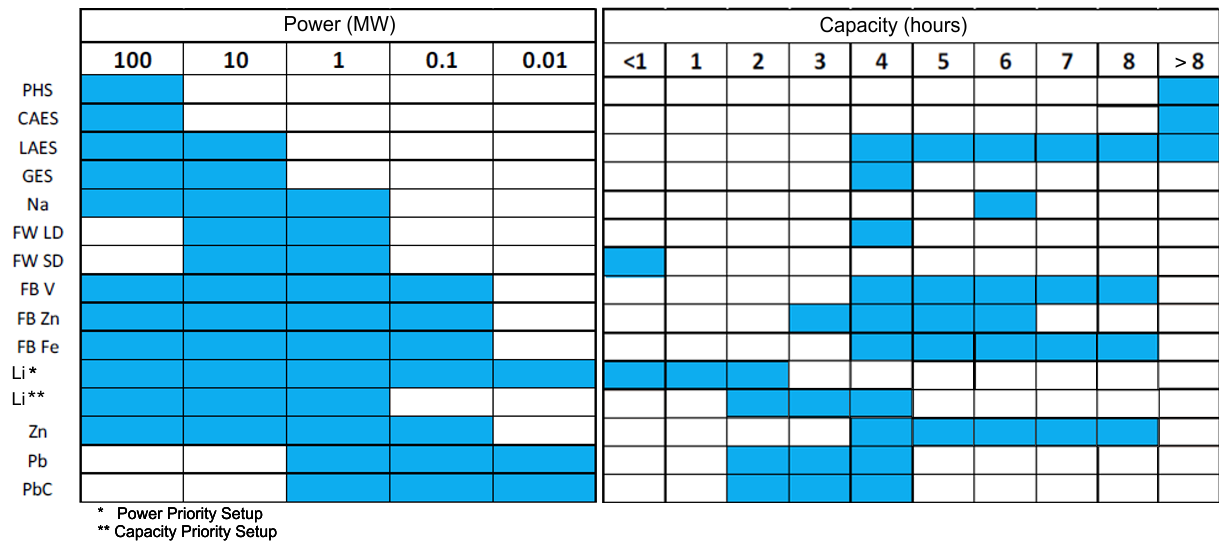

RETURN TO TOP OF THE PAGETextbook applications of energy storage are shown in the below table. It should be noted that performing any of the listed functions may depend on the location of the energy storage in a given place, technical parameters of the storage, legal conditions and economic calculation. While the concept of economic calculation has generally good associations, unfortunately, it must be said that perhaps one of the biggest reasons that energy storage has not found wider application in Poland so far is due to the fact that penalties paid for not keeping quality parameters are microscopic compared to capital expenditures related to the installation of an energy storage. Of course, this may change in the future, and looking at the dynamics of the increase in complaints and claims for lost profits, perhaps soon the cost of installing an energy storage to improve quality parameters may no longer be treated as an obstacle. Mentioning the legal conditions, it is worth noting that the definition and recognition of energy storages in the Polish Energy Law appeared in mid-2021. From the Polish DSO's point of view, significant legal regulations entered into force at the beginning of March 2023. More on this topic is provided in the section: "Energy Storage Systems legal framework in Poland".

The energy storage can work with the whole spectrum of the integrated utility enterprise's assets, providing a range of services. Energy storage, enables:

Once the share of weather dependant generation installed power reaches certain level in total installed power of National Power System it may become challenging and costly to prevent exceeding the permissible levels of phase voltages, i.e. voltage increase above the allowed range at low grid load and high active power generation, and failure to meet the minimum grid voltage value at high grid load and lack of sufficient photovoltaic and wind generation. Energy storage is the best tool to reduce the risk of overloading network elements and support efficient management of overvoltages.

The inability of the DSO to control (due to technical limitations and legal terms) the inverters of PV installations limits the possibility of connecting new installations. This results in a less than optimal share of generation from RES, as the available connection capacity is left unused so that the grid is not overloaded during periods of increased generation from RES. The use of an energy storage facility allows for connecting more RES installations. Integration of energy storage with the operation of MV/LV substations supports the power system's ability to respond to changes in demand and generate electricity in a way that ensures the security of energy supplies and, at the same time, optimal use of its sources.

Frequency is a key parameter in an AC power system. Deviations from the nominal frequency are a consequence of an imbalance between supply and demand; excess generation causes an increase in frequency, and excess demand causes a decrease in frequency. The incidence and magnitude of frequency interference increases with the increasing share of generation from RES.

Unbalanced power in the energy system is first compensated by changes in the kinetic energy stored in the rotating mass of large synchronous generators. It is an autonomous regulation. The task of primary regulation is to eliminate disturbances in the active power balance in the power system as quickly as possible. The primary control based on the rotating reserve, as the proportional control, cannot completely eliminate the static frequency deviation, but only limits its value. If statutory and operating limits are exceeded, generators will be forced to shut down, resulting in catastrophic failures. Energy storage is a tool supporting frequency regulation based on spinning reserve (inertia).

Power systems with a large share of RES connected to the grid via inverters, are characterized by low inertia and do not have the frequency reserve otherwise provided by synchronous generators. Thus, with the increasing share of RES, the frequency reserve decreases at the same time. Energy storage that can not only regulate their power output, but also are able to do so with much less delay than conventional generation can support the conventional frequency regulation reserve. Energy storages are usually connected to the grid through a power converter, which can actively shape the parameters, power quality, thanks to the speciall designe of its controllers.

The Energy Law sets maximum values of harmonic distortions that are permitted in the power system. Harmonic distortions cause: (1) failures of contactors and protections, (2) power losses in transformer stations and transmission lines, (3) increase in current in the neutral conductor, (4) electromagnetic interference, (5) malfunctions and failures of powered electronic devices. The energy storage can perform as an active harmonic filter and keep hermonic distortions within safe limits.

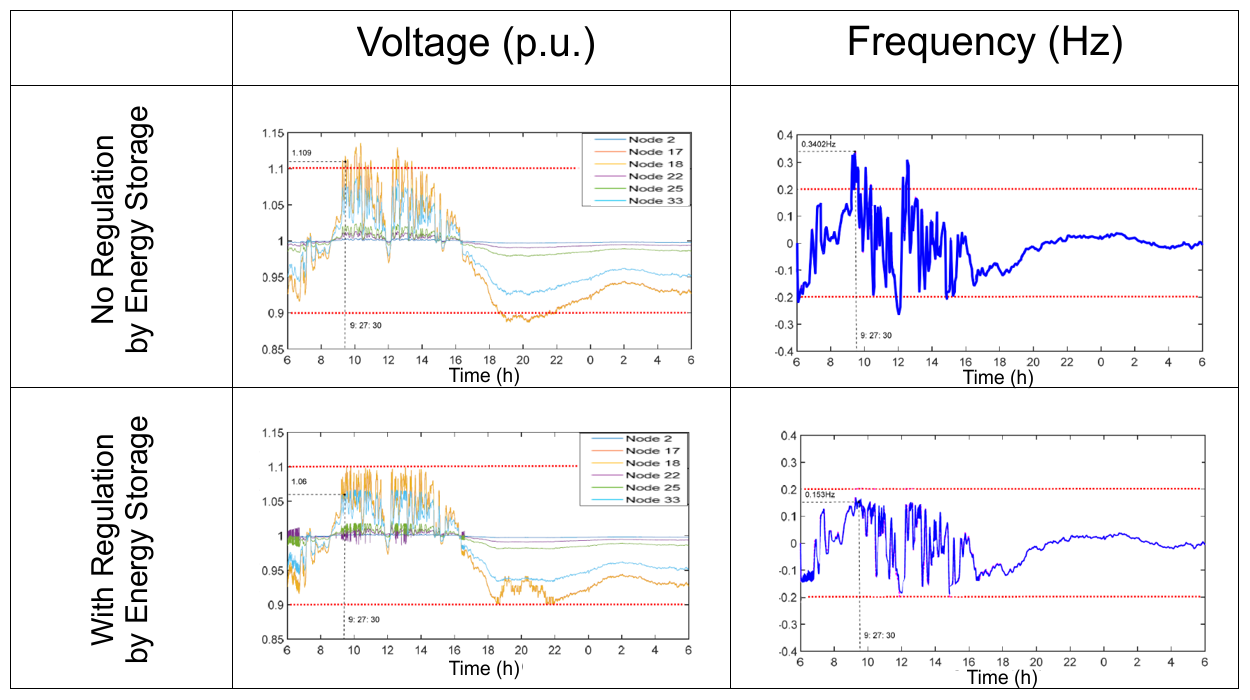

Improvement of voltage and frequency stability can be observed on the below example (Ota, Japan) thanks to an algorithm which controls 2.9 MW energy storage collocated on a 9 MW PV site. Daily load in this example oscillates between 2.3 MW and 5.0 MW.

Based on: Voltage/Frequency Deviations Control via Distributed Battery Energy Storage System Considering State of Charge,Yongzhu Hua 1, Xiangrong Shentu, Qiangqiang Xie and Yi Ding

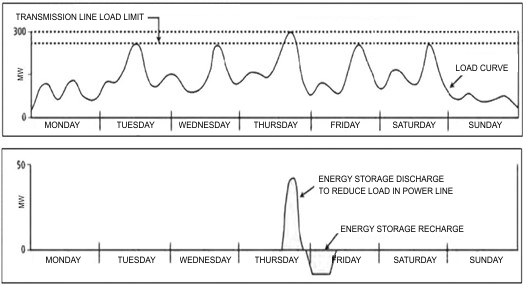

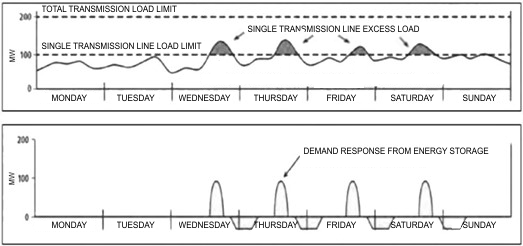

Economics can support Energy storage as an alternative to the construction of additional lines, especially if peak load duration is relatively short.

RETURN TO TOP OF THE PAGE

RETURN TO TOP OF THE PAGE

There are 15 types of energy storage systems. technology:

Operational characteristics of different energy storage systems are as follows:

The economy of a project dictates optimal power and capacity configuration for each type of storage :

RETURN TO TOP OF THE PAGE

RETURN TO TOP OF THE PAGE

Pumped Hydro Storage

In Poland, similarly to other countries, the dominant role for the storage of electricity is played by pumped-storage power plants (PSPP) or what they are sometimes called Pumped Hydro Storage (PHS). The installed power of PHS is 1.8 GW and it is planned to build additional facilities with an installed power of 3.3 GW. After the planned investments are completed, the total installed power of PHS in Poland will reach 5.1 GW. More information on each ESP can be found at: PUMPED HYDRO STORAGE IN POLAND

Battery Energy Storage Systems

Polish DSOs have built several pilot battery energy storage systems (BESS). The full list of BESS known to us in Poland can be found at:

BATTERY ENERGY STORAGE SYSTEMS IN POLAND

Among the BESS built in Poland, the following are particularly noteworthy due to their size or function:

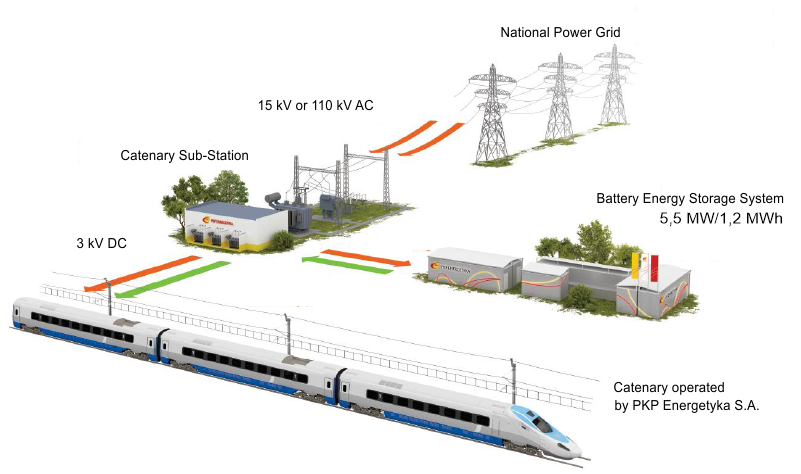

- Garbce, built in 2021 by PKP Energetyka, 5.5 MW 1.2 MWh

- Bystra, built in 2019 by Energa Wytwarzanie, 6.0 MW 27MWh

- Cieszanowice, built in 2019 for Tauron Dystrybucja, 3.0 MW 0.7 MWh

- Rzepedź, built in 2020 for PGE, 2.1 MW 4.2 MWh

- Bełchatów, built in 2020 for PGE GIEK, 1.0 MW 1.0 MWh

- Puck, built in 2016 for Energa Operator, 0.75 MW 1.5 MWh

- Lubachów, built in 2019 for Tauron EkoEnergia, 0.5 MW 2.0 MWh

According to data from PKP Energetyka S.A. construction of the Garbce 5.5 MW/2.1 MWh Battery Energy Storage System cost PLN 19.9 million. This BESS is charged slowly when there is no train on this section of catenary. The BESS discharges energy when a train passes by. The instantaneous amount of energy taken from the National Power Grid is much smaller in this way. This BESS works directly on 3kV DC voltage and is the largest catenary BESS in Europe. It uses a DC/DC converter (7 x 0.92 MW) and is equipped with a dedicated work algorithm, patent pending. Lithium-nickel-manganese-cobalt (LiNiMnCoO2) batteries were used. The power demand of the Pendolino train is approximately 6MW, which is more than the available power for this section of the catenary. The use of the BESS allowed to avoid exceeding the contracted power.

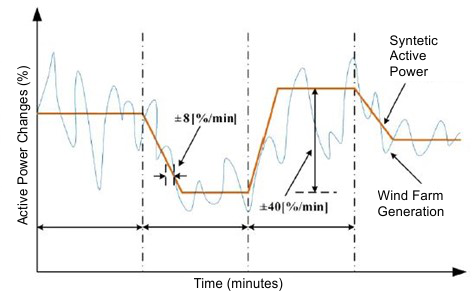

Built in cooperation between entities from Poland and Japan, BESS with rated power of 6MW and a capacity of 27.3 MWh is currently the largest and most modern battery energy storage in Poland. It was located in the immediate vicinity of the Bystra wind farm near Gdańsk. BESS at the Bystra Wind Farm is fitted with a modern network protection system (Special Protection Scheme - SPS), implemented in cooperation between the Japanese side and Polskie Sieci Elektroenergetyczne (TSO). The SPS system in conjunction with the battery energy storage can significantly support the management of the national power system in the conditions of increased operation of wind farms and increased production of energy from this type of renewable sources. The implemented solution, as well as the compatible BESS operated by Energa OZE, is a significant contribution that shows the path for further development of renewable sources in Poland.

Cieszanowice 3MW/0.7 MWh BESS has been built by Tauron Dystrybucja S.A. at a total cost of PLN 12 million. This storage is designated to cooperate with the Lipniki Wind Farm 30.75 MW. The rated power of the BESS is 3.16MVA and the usable capacity is 773.66kWh. BESS battery cells use LTO technology and are placed in a single 45-foot container containing six 139kWh modules with a dedicated FiFi 4 Marine extinguishing system. Battery life is estimated at at least 25,000 cycles. The period of the guaranteed capacity of 500kWh is 15 years. BESS is equipped with the following systems: BMS+EMS integrated with SCADA, HVAC with liquid cooling of battery modules, fire protection, monitoring, alarm.

Basic functions of ME Cieszanowice:

- Ramp Rate Control (a system that controls the rate of changes in the installation power),

- smoothing active power fed into the grid,

- voltage and frequency regulation

- elimination of voltage dips, regulation of flow values and directions ±Pn and ±Q,

- peak smoothing

- the ability to frequently change the output power in the range from 0% to 100% of the maximum power and change the direction of energy flow charging/discharging -100%/100%

- black start (restoring to operation without the need to use external power)

- work in the island variant

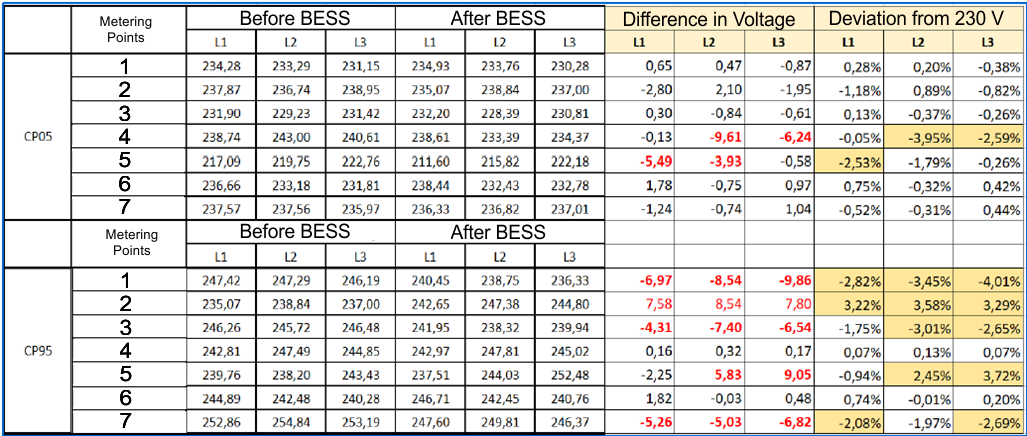

According to data from PGE S.A. the construction of the Rzepedź 2.1 MW/4.2 MWh energy storage facility cost PLN 15 million and was selected as a favorable alternative to the construction of 45 km of 110kV line.

Measurement data from BESS in Rzepedź show that the installation managed to limit deviations in voltage parameters.

RETURN TO TOP OF THE PAGE

RETURN TO TOP OF THE PAGE

The basic revenue streams for energy storage facilities come from:

- participation in the capacity market,

- regulation services,

- price arbitrage on the energy market.

For integrated utilities, savings in balancing costs resulting from the lack of the need to rebalance at spot balancing market rates, may be a significant input towards the economics of energy storage business.

When developing a business model for an energy storage facility, the proceedings of the European Commission regarding simultaneus participation of a unit in the Polish capacity market and regulation services market should be taken into account. Professionally, we deal with the development of detailed business models for the operation of energy storage facilities, Feasibility Studies. More information on this topic you can fine in our

MAIN MENU

>>

The capacity

market, apart from the energy market, is a separate segment of the

dual-commodity electricity market. Energy Storage can participate in capacity market in Poland.

Capacity market participation means a unit takes "capacity

obligation" service which consists of:

a) maintain capablity to supply electric power to the

system at 8 hour notice, and

b) obligation to deliver a specific power to the system in the emergency

period for 4 hours.

The primary market takes the form of an auction organised by the Transmission System Operator (TSO) being the only buyer. The selection of capacity market units that

will offer the service for an appropriate remuneration is made as a result of

Dutch-type auctions, i.e. auctions consisting of many rounds with a decreasing

price. Capacity market units that will be admitted to participate in the

auction, after successful completion of the general certification process and

then the certification process for the main auction, will leave the auction

when the price of the next round no longer provides their expected remuneration

for their capacity obligation service. As a result, auctions will be won by the cheapest bids while

maintaining technological neutrality.

The primary market consists of a main auction, which takes place four years

before physical delivery, and a secondary auction, which takes place one year

before physical delivery. In 2018, three auctions were held for the delivery

years 2021, 2022 and 2023. Art. 29 sec. 3 of the Act on the Capacity Market

provides that during the years 2019 - 2025 one main auction will be held each year for

the delivery periods falling respectively in the years 2024 - 2030. Based on a regulation issued in accordance with article 34 of the Capacity Market Act the auction

parameters are defined by the minister competent for energy, in consultation with the President of the Energy Regulatory Office.

Payments for capacity obligation constitute state aid. The Capacity Market Act

was subject to the notification process, the European Commission approved the

aid program by Decision of February 7, 2018 (State aid no. SA.46100 (2017/N),

C(2018) 601 final).

The capacity auction for 2026 which took place on 16 December 2021 by Polskie Sieci

Elektroenergetyczne (Polish TSO) ended in the first round. The total volume of capacity

obligations offered and purchased as a result of this auction is 7.2 GW (almost

80% was contracted by generation units, and over 20% by demand reduction units,

the so-called DSR). As a result of the auction, agreements were concluded with

26 capacity providers covering a total of 128 capacity market units (including

89 Polish physical units and 39 foreign units). Units from outside the

territory of the Republic of Poland - from the area of the transmission

system of the Kingdom of Sweden - took part in the capacity auction for the

first time. The closing price for Polish physical units was PLN 400.39/kW/year,

and PLN 399/kW/year for foreign units. The total amount of capacity obligations

contracted as a result of previous auctions for the 2026 delivery year is 11.5

GW. Thus, in total, capacity contracts for approx. 18.8 GW were concluded for

2026. Detailed data and information on the settlement of the auction can be

found in the Information of the President of the Energy Regulatory Office No.

2/2022.

The capacity auction for 2027 conducted on 15 December 2022 by Polskie Sieci

Elektroenergetyczne ended in the first round with a closing price of PLN

406.35/kW/year for capacity market units consisting of Polish physical units,

and PLN 399.00/kW/year for foreign units. Capacity contracts for 18.7 GW

have been concluded for the delivery year 2027.

Secondary

capacity market

Supplementary to the primary market, in order to limit the risk of

capacity market participants, a secondary market has been provided by law, where

capacity obligations of certified capacity market units can be traded. Transactions on

the secondary capacity market include two basic types of contracts:

- transferring the capacity obligation of a capacity market unit in whole or in

part to a capacity market unit of another capacity provider for the future supply period, after additional auctions have been completed (it is an instrument

for managing the risk of planned unavailability);

- ex post reallocation of the volume of the capacity obligation between

capacity market units in case of failure to perform the capacity

obligation by one capacity market unit and excess delivery by another capacity unit

during an emergency period (it is an instrument for managing the risk of unplanned unavailability,

usually applied to smaller volumes of capacity for a short periods).

Transactions in both of these categories are allowed to take place both on

organized markets and directly between capacity providers. The TSO is not an

entity operating the secondary market, transactions concluded on this market by

capacity providers only require notification to the capacity market register.

Participation in the secondary market is subject to the process of

certification of capacity suppliers.

Value of the

capacity market in Poland

According to the data published by the Energy Regulatory Office, based on

information from PSE SA (Polish TSO), the annual costs of the

capacity market totals at PLN 5.5 billion in the 2021. Without

taking into account the results of additional auctions, the costs for the years

2022 to 2025 has already exceed PLN 5 billion for each year.

Cross-zonal

transmission capacity

In order to ensure competitive access to the capacity market, Art. 16 sec. 8 of

Regulation 2019/943 imposed an obligation on the TSO to make cross-zonal

capacity available to market participants at a level not lower than 70% of the

transmission capacity at a given border or critical network element, taking into account system's operational safety limits. Since the above

conditions were not possible to be met by the Polish TSO at the time of entry

into force of the relevant provisions, pursuant to Art. 15 of the above

regulation, an action plan was developed by the competent ministry, in

cooperation with the President of the Energy Regulatory Office and the Polish

TSO, specifying the level of minimum transmission capacities for cross-zonal

trading, which will be made available to market participants by the Polish TSO

from the beginning of 2020 to the end of 2025.

Emissions restrictions for capacity market units

Due to the requirement of Regulation 2019/943, new power plants that emit more

than 550 grams of CO2 per kWh of electricity and that will start operating

commercially after the Regulation enters into force in 2019 are not allowed to

participate in the capacity mechanisms . Therefore, they will not be able to

take advantage of capacity market revenue strems which are considered state support. On the other hand, existing power plants

emitting more than 550 grams of CO2 per kWh and more than 350 kg of CO2 per

year on average for each installed kW of capacity will be able to participate

in these mechanisms until July 1, 2025. These are the units that started

operating before the entry into force of the regulation. It was also necessary

to introduce changes to the capacity mechanism functioning in Poland. Despite

the loss of revenues from the capacity market, units that do not meet the

emission requirements will not disappear from the energy system overnight.

Formally, they will be allowed to operate however their revenues will come from the energy

market only. The 550 gCO2/kWh limit is currently not met by any Polish coal or

lignite-fired power plant.

Forecasts for

the capacity market in Poland

The summary of PSE's forecasts regarding the coverage of the power demand

showed that for ensuring the security of electricity supply in

the coming years it is required to timely commission new generation sources which are planned or under construction. According to the Polish Supreme Chamber of Control (Polish: Najwyższa Izba Kontroli - NIK), all of the audited investments were

undertaken or completed with a delay in relation to the initial assumptions. Investments covered by the audit, at practically every stage (from

preparation, through the selection of a contractor and the building works phase), there were delays and postponements of deadlines, resulting in a

corresponding postponement of the date of putting the units into operation. According to the Intrastat analysis, the change in the

generation structure will translate into a sharp decline in the share of coal

in domestic electricity production. This share will fall from 70% in 2020 to

13% in 2030. In 2040, electricity from coal will be produced only in combined

heat and power plants and industrial power plants. The share of RES will

increase to 76% in 2030 and 90% in 2040.

According to

PSE's forecast for the years 2017-2035, under the modernization scenario, the

total demand for new generation capacity until 2035 will amount to

approximately 22 GW, and in the phase-out scenario even 28 GW. In

the near future, it is necessary to commission a total capacity of

approximately 5,300 MW while maintaining the largest possible part of the

currently operating generation capacities. PyPSA -PL model of the Polish energy market created by the Instrat Foundation, was used to estimate the impact of the restructuring plan on the power balance in the National Power

System. The key conclusions are as follows:

- The pace of RES development outlined in the latest official version of

PEP2040 (government planning document) is not sufficient to ensure Poland's energy security;

- Shutting down

power plants in accordance with the schedule presented in the restructuring

plan generates a huge gap in the power balance, although this pace is still too slow

to implement EU emission reduction targets or provisions of the Paris

Agreement;

- From 2030 there will be significant shortages in the National Power System, which in

2040 will reach 23 TWh (i.e. approx. 10% of gross demand);

- The gap in the power balance exists despite the assumptions about the timely

implementation of offshore wind farm projects, a nuclear power plant and

gas-fired units.

Potential costs of penalties for failure to meet the capacity obligation:

For the year 2022, the unit penalty rate for failure to meet the capacity obligation was set at PLN 4,437.68/MWh. The penalty calculation formula set in the Regulation of the Minister of Energy of July 18, 2018 on the capacity obligation performance, its settlement and demonstration, and the conclusion of transactions on the secondary market, Journal of Laws, item. 1455 is as follows:

where:

We professionally advise both in the certification process for the capacity market and in the preparation of Feasibility Studies for energy storage systems in Poland. More information about our services can be found in MAIN MENU >>

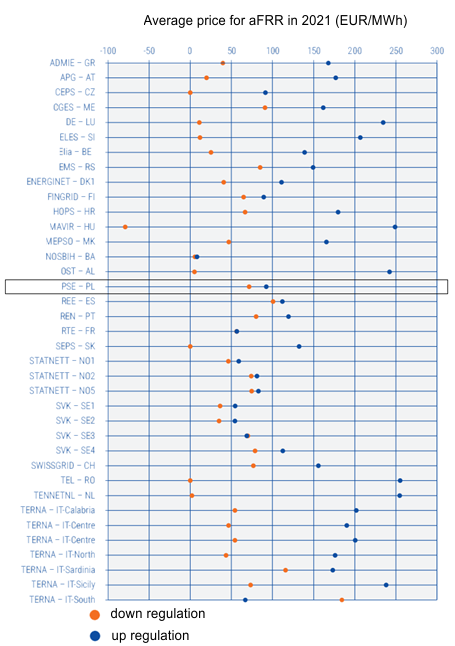

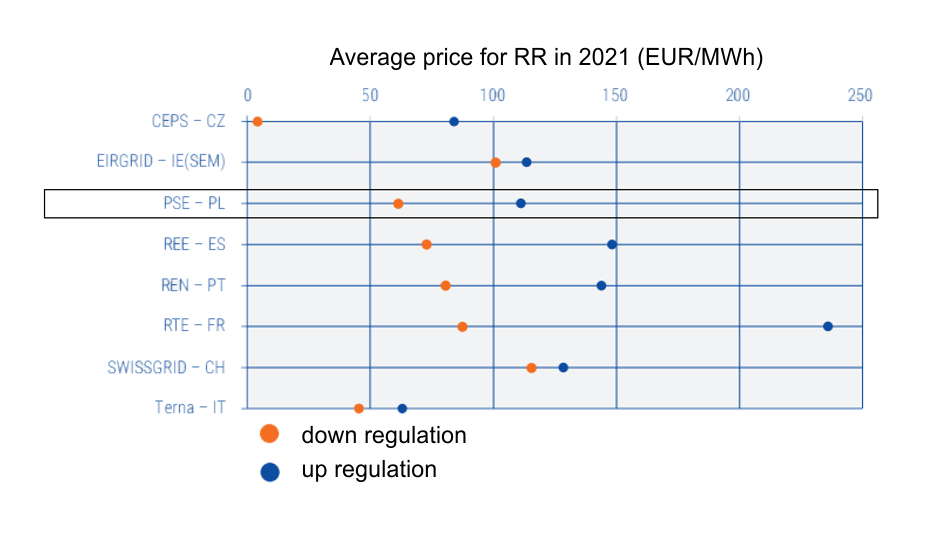

It should be noted that, in accordance with the Capacity Market Act, it is not possible to provide ancillary services and capacity market services in the same year, so the revenue streams from these sources are mutually exclusive. However, it is possible to trade capacity obligations on secondary market and participate in the ancillary services market if the market price for these services is attractive. The model assumes that ultimately FCR, aFRR, RR prices will converge at the European level due to the ongoing integration of the Polish power system with European counterparts using the following platforms:

- PICASSO (aFRR - automatic secondary regulation)

- MARI (mFRR - secondary regulation)

- TERRE (RR - tertiary regulation)

The following charts show the average prices of automatic secondary regulation, average prices of tertiary regulation in the ENTSO-E area (association of power transmission system operators) based on "ENTSO-E Balancing Report 2022"

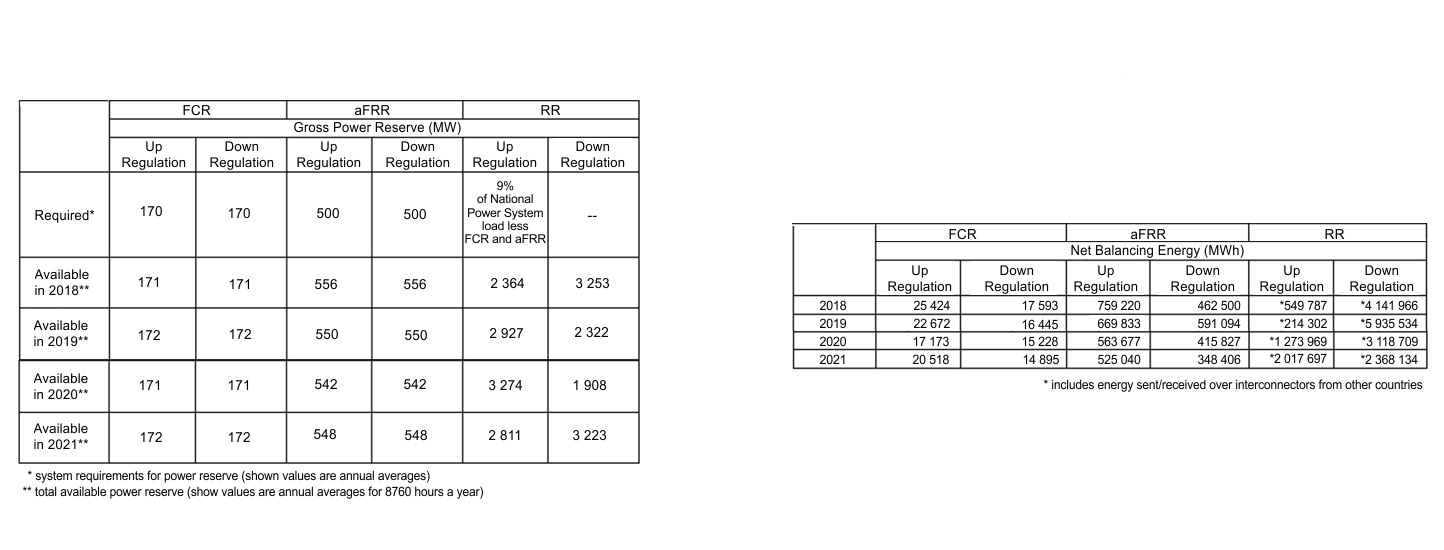

According to PSE S.A. (Polish TSO) reports for 2018-2021, the required reserves and realized volumes are as follows:

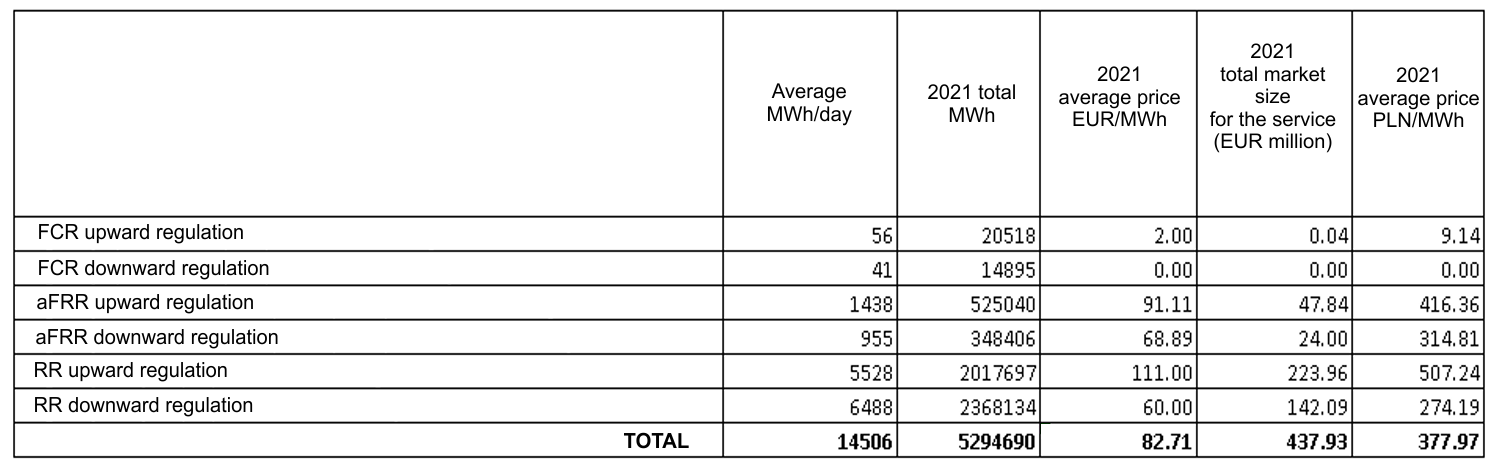

Based on the "2022 ENTSO-E Balancing Report" and the volumes provided by PSE, the value of the regulatory services market in Poland in 2021 and the unit prices of individual services can be estimated as follows:

The amendment to the Energy Law that was made in March 2023, imposed an obligation on DSOs to offer competitive access to the market for local stabilisation and balancing services. This created new opportunities for energy storage business to provide services both to the TSO and the DSO.

We professionally advise on an optimal model of energy storage operation in Poland, taking into account the market of ancillary services. More information about our services can be found in

MAIN MENU

>>

Pursuant

to Commission Regulation (EU) 2017/2195 of November 23, 2017, Polish Balancing

Conditions (Polish: Warunki Dotyczące Bilansowania) were amended (Amendments

No. 1/2020). The document introduced Active Storage Scheduling Unit (Polish: Jednostka

Grafikowa Magazynu aktywna - JGMa) and the associated Storage Scheduling Billing

Unit (Polish: Jednostka Grafikowa Magazynu rozliczeniowa - JGMr ). In addition,

two types of activity on the Balancing market were distinguished, identified by

the Activity Marker (Polish: Znacznik Aktywności - ZAK). The Scheduling Unit which

has ZAK=1 actively participates in the Balancing market and is subject to the dispatch

by the Transmission System Operator with the scope of changing the power and operating

status of the Scheduling Unit, within the full available power range of the

Scheduling Unit, taking into consideration the commercial and technical data

reported for the Scheduling Unit.

The Amendments to the Balancing Conditions introduced a dedicated solution for

active participation in the Balancing Market of electricity storage facilities as

well as pumped-storage power plants. Newly

introduced JGMa and JGMr are characterized by the ability to charge (offtake

load) and discharge (generate electricity) to the extent that charging and

generation are possible due to the state of charge of the electricity storage

or pumped-storage power plant.

The amendments to the Terms and Conditions introduced new rules for determining

the settlement price of forced delivery of electricity (CWD) and the settlement

price of forced electricity offtake (CWO).

CWD and CWO prices for JGM are determined for the trading day, based on:

If

an energy storage that meets ZAK=1 marker criteria is deployed, it will remain

at the dispatch of the TSO for balancing purposes. This fact may be a

significant limitation for the energy storage ability to operate freely on other

markets, not only during the period of forced work, but also after its

completion, as the state of charge of the warehouse may differ from what would

be optimal for other operation. There is a risk that the Balancing Market forced

work may prevent the operation of the storage on the energy market during peak

hours, i.e. in a situation when commercial discharging of the storage is the

most profitable.

If we accept the assumption that the pricing formula established in Balancing

Conditions is close to LCOS (Levelized Cost of Storage) and apply a 5% margin

to this cost, which is set in the Balancing Conditions, then it would be

possible to estimate in a very simplified way the revenue from completing one

full cycle by a large-scale energy storage in the range from PLN 442.83/MWh to

PLN 548.40 /MWh. This amount results from the LCOS value increased by 5% of the

margin and the energy storage efficiency factor, which is compensated in the

price of CWD and CWO. It is difficult to state unequivocally to what extent

this value can be indexed by the inflation rate, because its calculation is

based on LCOS, whose component is CAPEX, for which there is no basis for valorisation.

The part of LCOS that results from OPEX can be indexed in the model by referencing

to inflation rate.

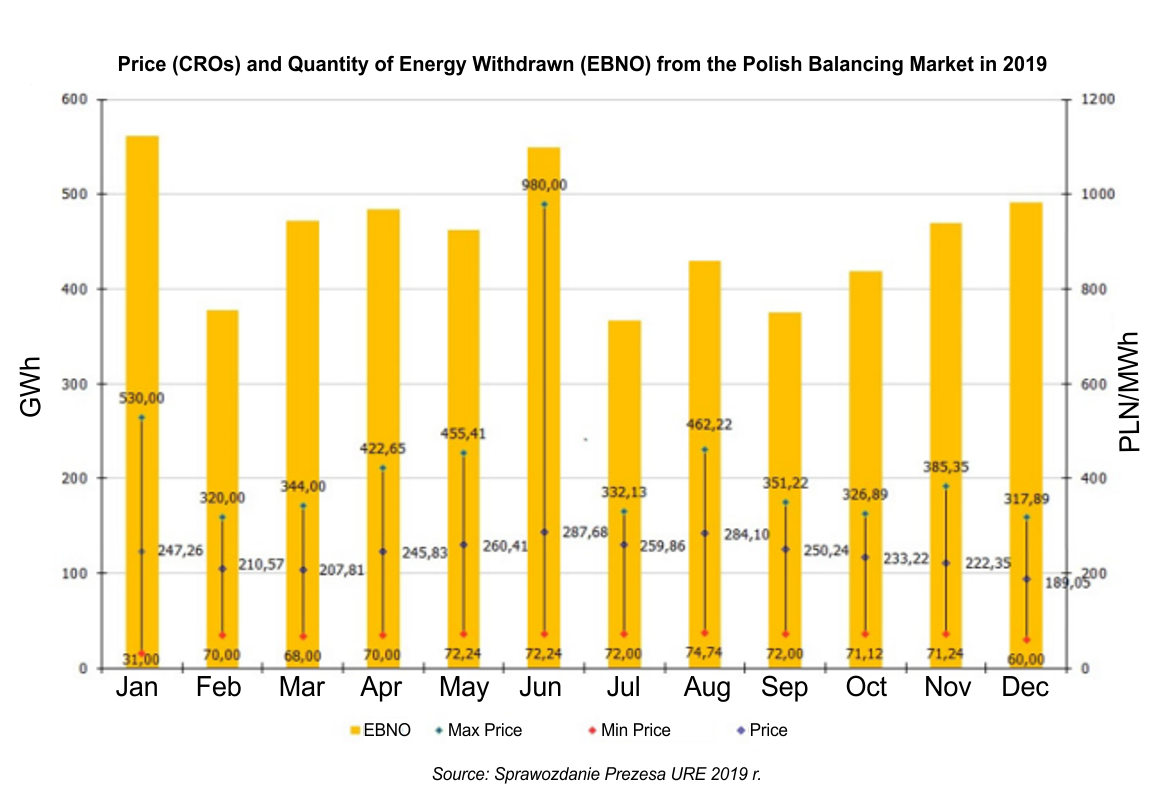

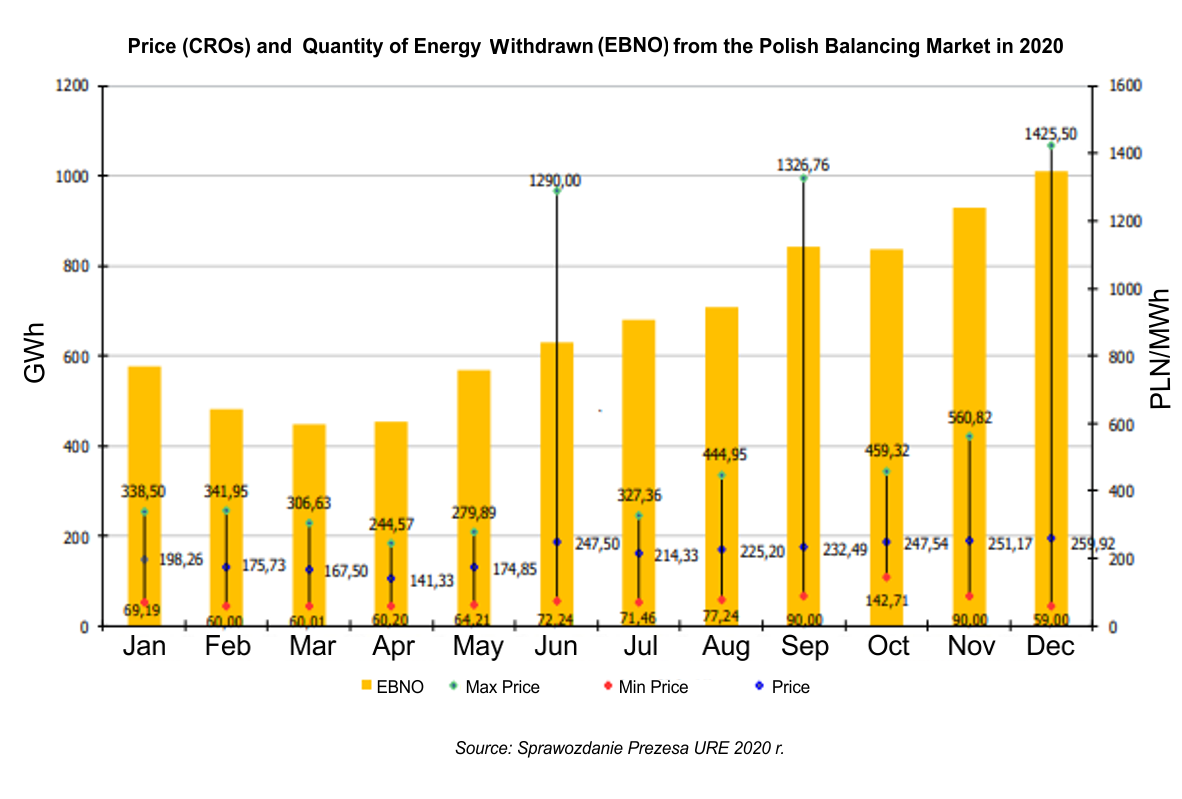

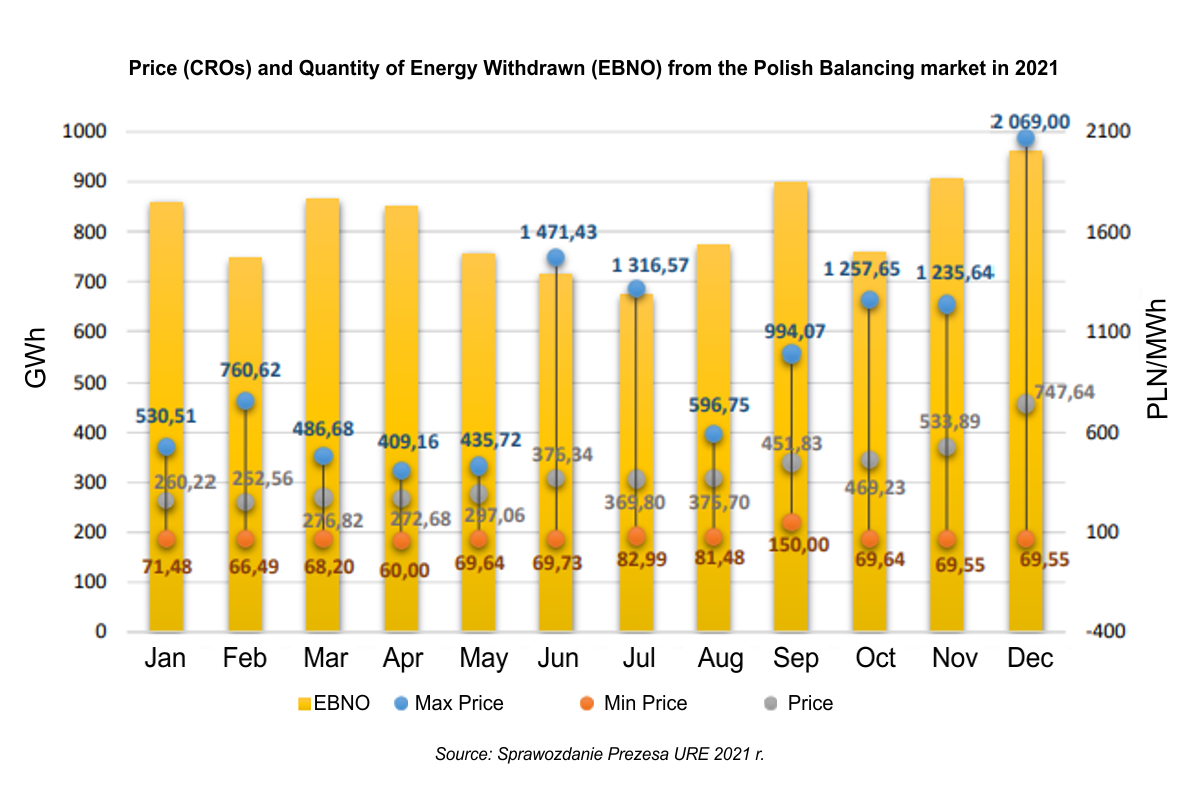

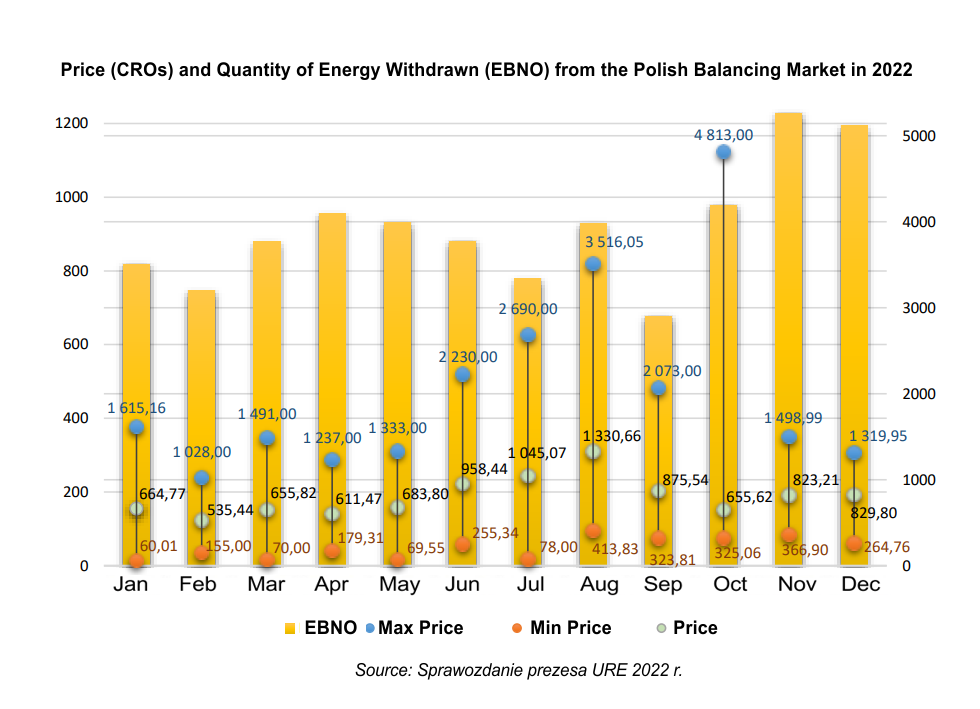

Although Balancing Conditions introduced a dedicated formula for calculating

CWD and CWO for energy storage, it is worth noting that the average price of

CROs on the balancing market only in the second half of 2021 reached a price

ceiling close to the price resulting from the calculations of our model. In

2022, the price spread on the balancing market has widened further, in

particular in the aftermath of the war in Ukraine and gas price spikes, which

is a fuel largely used for rapid generation upscaling for balancing purposes.

Description of abbreviations:

EBNO - Amount of settled imbalance energy withdrawn from balancing market

EBND - Amount of settled imbalance energy deliverd to balancing marketComments:

To present the total amount of energy delivered and withdrawn from balancing market the JGOSPa (representing pump storage units) uptake of energy is included in EBNO values.

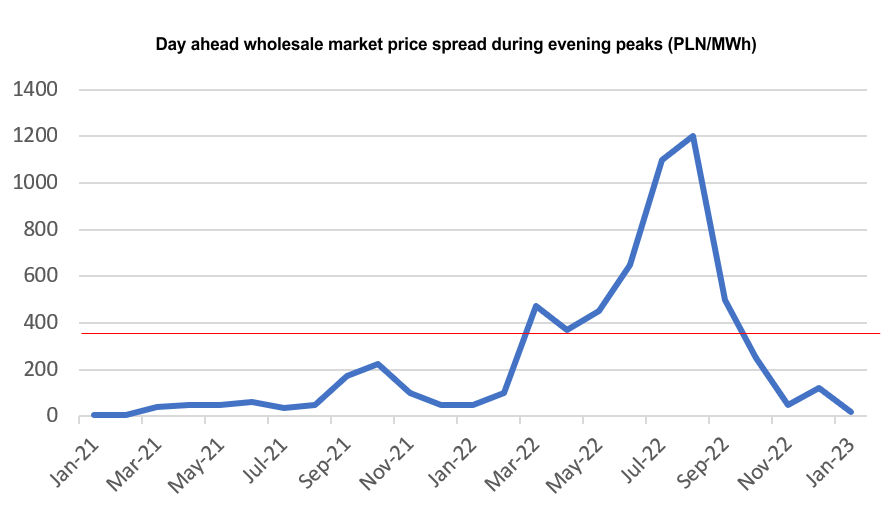

Assuming that the main factors causing large daily price swings on the balancing market are the high price of fuels such as gas or coal and growing share of generation from weather-dependant sources, it is expected that the high intra-day price volatility on Balancing Market will be maintained in the years to come.

We professionally advise on the participation of energy storage in the Balancing Market in Poland.

More information about our services can be found in

MAIN MENU

>>

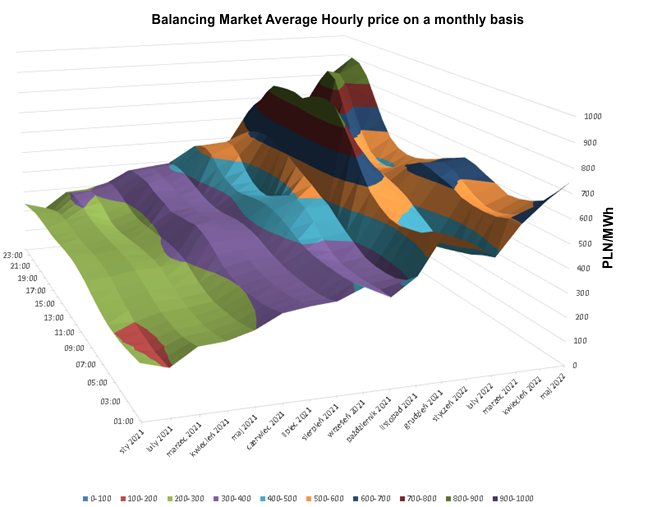

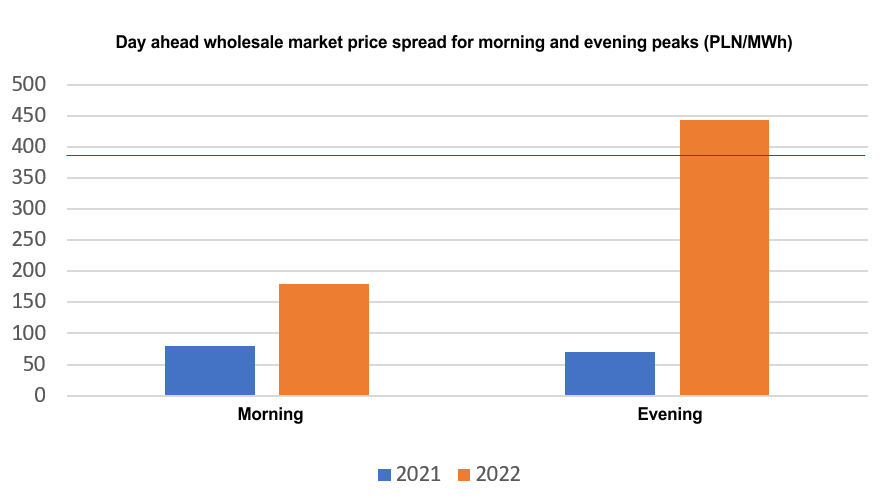

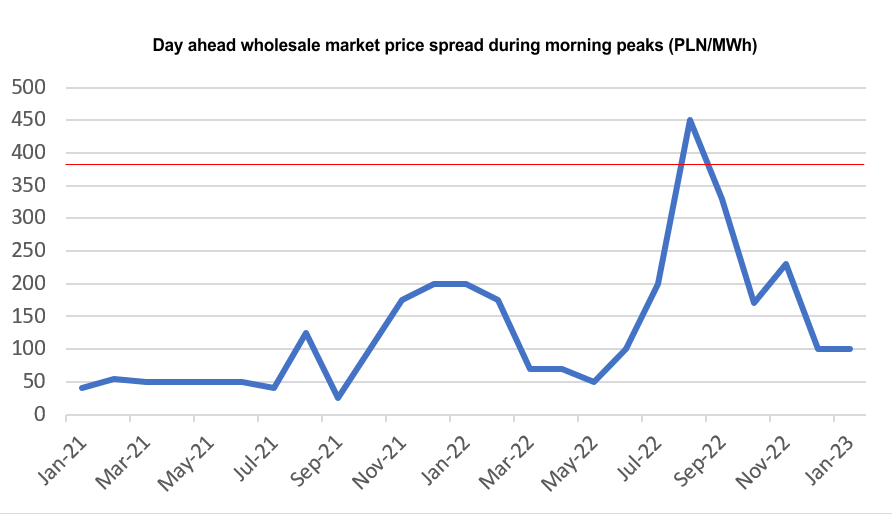

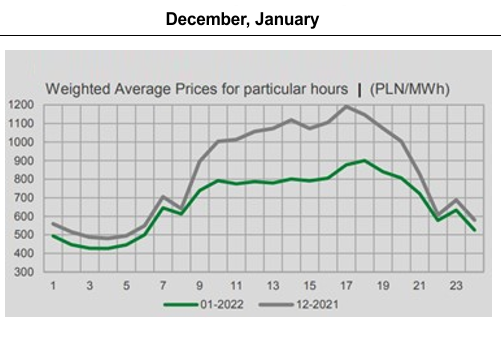

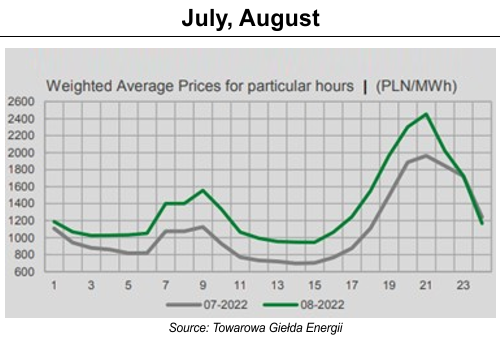

In 2022, the price range between the midnight/midday trough and the morning/evening peaks significantly increased compared to 2021. The charts below on the vertical axis show the average prices per MWh in Polish zlotys from TGE RDN quotations.

As a rule, in months with high generation from photovoltaic sources, the price range in the evening peak is greater than during other months.

Taking into account the break-even level for each cycle of an Lithium-Ion battery energy storage (LCOS) at an estimated PLN 388.00, the economic viability of making arbitrage trades exists generally between March and October. The daily price range is, as a rule, the greater the greater the share of generation from photovoltaic sources. The daily graph takes the shape referred to as the "duck curve".

Eenergy storage operating on just one market is unlikely to reach the break-even point. Most profitable business model for energy storage would be to operate on two or three markets and switch between markets using an algorithm capable of forecasting some data points for the day ahead energy market. It is still quite likely that operating on any two markets would allow to make a positive rate of return on investment. Of course, the above does not take into account the technical benefits for integrated utility enterprises resulting from having an energy storage facility and for example reduce balancing costs or postpone grid investments. Based on our model parameters and simplified assumptions that there is no conflict of market participation combinations, the internal rate of return possible to achieve for an energy storage is presented in the table below:

where:

We professionally advise on the participation of energy storage in the Balancing Market in Poland.

More information about our services can be found in

MAIN MENU

>>

Energy storage legal

framework in Poland is provided in:

• the Act of April 10, 1997, the Energy Law (Journal of Laws 2022, item 1385,

as amended)

• the Act of February 20, 2015 on Renewable Energy Sources (Journal of Laws

2022, item 1378, as amended)

• Act of December 8, 2017 on the Capacity Market (Journal of Laws 2021, item

1854, as amended)

• Excise Duty Act (Journal of Laws 2022, item 143, as amended).

Until mid-2021 storing of electrical energy, was not specified as a separate

type of energy processing, apart from e.g. production, transmission or

distribution. In 2021, Energy Law was amended, and storage of electricity gained

recognition. Currently, all 3 acts of key importance for the electricity

storage market have a unified statutory definition:

• Art. 3 point 10k of the Energy Law: energy storage – enabling to store of

electricity and introduce it back the power grid;

• art. 2 point 17 of the Renewable Energy Sources Act: energy storage -

electricity storage within the meaning of Art. 3 point 10k of the Energy Law;

• art. 2 point 18 of the Capacity Market Act: electricity storage facility

referred to in Art. 3 point 10k of the Energy Law.

The amended Energy Law Act introduced comprehensive provisions for the

operation of electricity storage facilities in the National Power System. The

regulation aims to create conditions for the development of electricity storage

applications, including the removal of barriers that prevented investors from

obtaining economic benefits from electricity storage facilities. The

development of battery energy storage technology opens new possibilities for

its practical use in various areas of the power system. It is estimated that

the storage of electricity on a large scale will be a key factor facilitating

the functioning of the power system. On the one hand, it will affect the possibility

of buffering significant volumes of generation from renewable energy sources,

and on the other hand, it will stabilize the operation of the power system and

improve the security and quality of electricity supplies to consumers. The use

of electricity storage will create the possibility of a quick response to

changes in the demand for power in the National Power System and will improve

the voltage stability of the grid's operation. It will also have a positive

impact on the scope of investments in the grid thanks to the possibility of

using storage technology instead of grid investments where it will be

profitable and will allow to integrate more energy from renewable sources with

unstable characteristics.

The most important of the legal provisions include:

• fee for connecting an electricity storage to the grid will be limited to half

of the actual costs incurred for the connection,

• excluding electricity storage from the obligation to prepare tariffs, instead

of establishing contractual relations the principles of the free market and the

freedom to conclude contracts,

• liquidation of the so-called double charges for transmission and

distribution, i.e. the adoption of the balance rule in the settlements for the

electricity transmission and distribution service, i.e. basis for settlements

of the network rate is the difference between the amount of electricity taken

by the storage facility and the energy re-introduced to the grid from this

storage facility, which is defined as a loss in the electricity storage

process,

• exemption from the excise duty on the purchase of electricity by an entity

operating in the field of electricity storage and holding a license for

electricity storage,

• exemption from the obligation to submit for redemption certificates of origin

for RES electricity collected and used by the storage for the purposes of

electricity storage,

• exemption of electricity storage from the RES fee.

Polish Balancing Market reforms follow the provisions of Clean Energy Package (CEP) framework:

as well as:

The most important assumptions of the CEP Regulation include non-discriminatory

access to the balancing market, which results from Art. 6.1 of Regulation (EU) 2019/943:

Balancing markets, including prequalification processes, shall be organised in such a way as to: (a) ensure effective non-discrimination between market participants taking account of the different technical needs of the electricity system and the different technical capabilities of generation sources, energy storage and demand response; […](c) ensure non-discriminatory access to all market participants, individually or through aggregation, including for electricity generated from variable renewable energy sources, demand response and energy storage; (d) respect the need to accommodate the increasing share of variable generation, increased demand responsiveness and the advent of new technologies.

and point 2.3.1. (17) of the Capacity Market notification decision:

Capacity providers will participate in the Polish capacity market in the form of Capacity Market Units (CMUs). It is at CMU level that certification applications are made, capacity agreements are held, obligations apply in times of system stress and penalties/over-delivery payments are calculated. Generation, storage and DSR capacity providers can all constitute CMUs.

Further changes are required in connection with the obligation to ensure market rules for obtaining balancing services under Art. 6.1 of Regulation (EU) 2019/943:

Balancing markets, including prequalification processes, shall be organised in such a way as to: [...] (b) ensure that services are defined in a transparent and technologically neutral manner and are procured in a transparent, market-based manner;

and Art. 6.8 of of Regulation (EU) 2019/943:

The procurement of balancing capacity shall be performed by the transmission system operator and may be facilitated at a regional level. Reservation of cross-border capacity to that end may be limited. The procurement of balancing capacity shall be market-based and organised in such a way as to be non-discriminatory between market participants in the prequalification process in accordance with Article 40(4) of Directive (EU) 2019/944 whether market participants participate individually or through aggregation.

and Art. 6.9 of of Regulation (EU) 2019/943:

The procurement of upward balancing capacity and downward balancing capacity shall be carried out separately, unless the regulatory authority approves a derogation from this principle on the basis that this would result in higher economic efficiency as demonstrated by an evaluation performed by the transmission system operator. Contracts for balancing capacity shall not be concluded more than one day before the provision of the balancing capacity and the contracting period shall be no longer than one day, unless and to the extent that the regulatory authority has approved the earlier contracting or longer contracting periods to ensure the security of supply or to improve economic efficiency.

and Art. 32.3 of the EGBL Regulations

The procurement of upward and downward balancing capacity for at least the frequency restoration reserves and the replacement reserves shall be carried out separately.

The

obligation to introduce an imbalance settlement period (ORN) of 15

minutes results from art. 53.1 of the EBGL Regulations:

By three years after the entry into force of this Regulation, all TSOs shall apply the imbalance settlement period of 15 minutes in all scheduling areas while ensuring that all boundaries of market time unit shall coincide with boundaries of the imbalance settlement period.

and Art. 8.4 Regulation (EU) 2019/943:

By 1 January 2021, the imbalance settlement period shall be 15 minutes in all scheduling areas, unless regulatory authorities have granted a derogation or an exemption. Derogations may be granted only until 31 December 2024.

In terms of integration with European balancing markets, the Poland is required to join the following systems:

More information can be found at: POLISH BALANCING MARKET REFORM SCHEDULE

RETURN TO TOP OF THE PAGECopyright © 2023 BESS LLC

All rights reserved